<!-- Google Tag Manager (noscript) -->

<noscript><iframe src="https://www.googletagmanager.com/ns.html?id=GTM-N69PD2M"

height="0" width="0" style="display:none;visibility:hidden"></iframe></noscript>

<!-- End Google Tag Manager (noscript) -->

A short guide to PSD2

Have you heard about PSD2 (Payments Services Directive)?

PSD2 is the revised European directive that regulates the rules of the game in payment transactions impacting all participants in the market: merchants, consumers and, above all, banks and other payment entities. So, whether you have an online store, or are a content provider it is important to understand the key concepts and implications behind the changes in the payments regulatory framework.

The Extended Payment Services Directive

The Revised Payment Services Directive (PSD2) is a set of laws and regulations for payment services in the European Union (EU) and the European Economic Area (EEA). It came into effect in September 2019, and it has brought significant changes to the industry by opening the market to new entrants and business models while maintaining the highest level of security in payment transactions.

PSD2 impacts all players in the online payment’s ecosystem:

Why do we need PSD2?

Since the initial regulatory framework in 2007 – PSD1, that the objective of the EU has been to stimulate an innovative and transparent environment in the European payments services market and simultaneously increase the quality of services and deter fraud in payments. Since then, the market has grown significantly, which has led to the extension of the initial directive

- There is increasing online payment fraud in Europe: online fraud now makes up 73% of fraud in Europe and it is rising.

- Rise of the API economy: APIs are fundamental to the success of tech companies, and they’ve supported the creation of whole new business models including fintech. APIs will provide the means for banking and payments to become more open.

- New payment business models: Since PSD1, there has been significant growth in the digital payments market. So far, these new business types have not been fully regulated. PSD2 will provide standards and structure and allow these new companies to access customer bank accounts.

So what does PSD2 bring to the table?

The main goal of this directive it to make the European payments market more integrated, efficient, lowering costs and becoming even safer for consumers and transactions. It improves the level playing field for payment service providers and promotes competition in the payment system by standardizing the rules.

Key changes for online sellers and payment providers

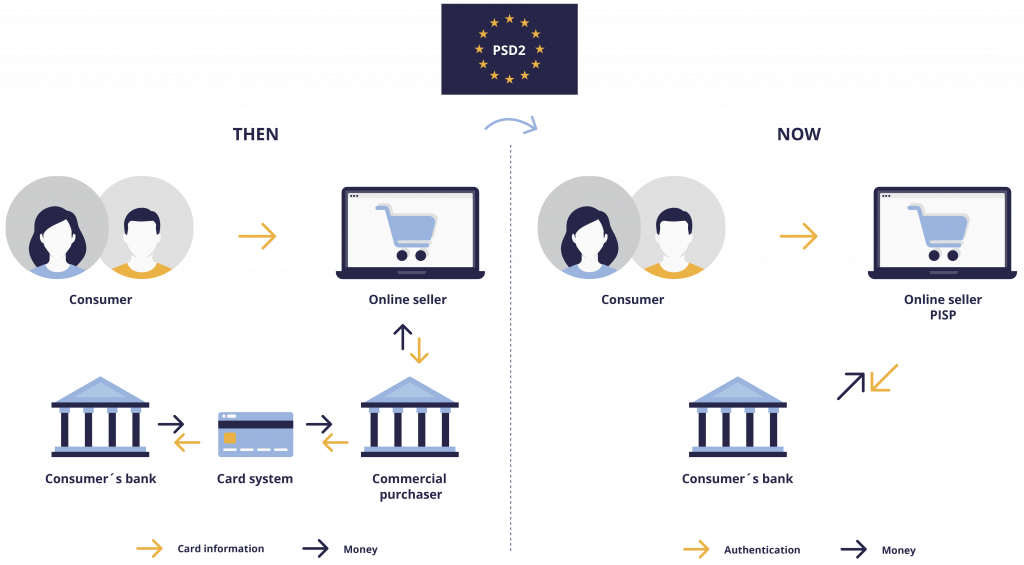

In the EU, PSD2 will open up payment transactions to non-banks (i.e. third parties). Two new types of entities are now allowed to operate in the market:

- Account Information Service Providers (AISPs)

- Payment Initiation Service Providers (PISPs)

The difference between these is that AISPs allow consumers to have a global view of their financial situation, by accessing one or more different payment for each holder and to categorise their spending according to different typologies. PISPs can initiate online payments or transfers directly from the payer’s bank account via an online portal.

Opening the market to new providers, new solutions and increased competition, will drive improvements in terms of the development of faster and smoother payments experiences and lowering payment transaction costs

At the same time, consumer protection is increased. Alongside more flexibility in online payments, PSD2 focuses in enforcing higher security standards for transactions. This is where measures like the implementation of SCA (Strong Customer Authentication) comes in place.

Strong customer authentication

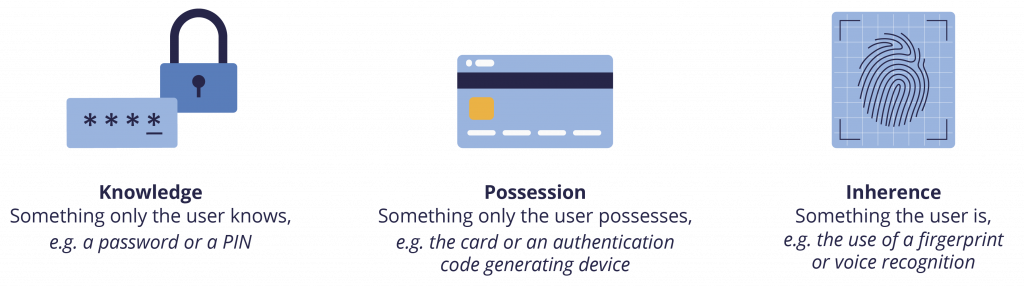

PSD2 has a requirement for Strong Customer Authentication (SCA). SCA is required to validate the user or the transaction for all digital payments. SCA involves a multi-step process, whereby two of three of the following elements must be met to validate authentication

These three elements are inherence, possession, and knowledge.

Or in other words, something the user is, something they have, and something that they know.

The focus on strengthened security requirements for digital payments aims to ensure the protection of consumers’ financial information and prevent fraud. This will in turn increase confidence in the market and contribute to its growth.

Operating in the digital payments market Go4Mobility is committed to drive sustained growth within the mobile payments market for online sellers and merchants, developing an increasingly convenient and secure experience for consumers.

In parallel with the continued investment in a unique checkout and payments experience, Go4Mobility is focused in protecting its customers and partners against cyber-insecurity, implementing the required measures, and working with trusted providers — such as the French company Evina — to ensure that transactions are increasingly secure and profitable.

If you are an online seller or content provider looking for more information on PSD2 and compliance standards or interested in knowing more about the solutions and payments services we provide worldwide, please reach us at info@go4mobility.com.

Recent articles

Categories

- Articles (42)

- Blog (14)

- Case studies (2)

- Culture (2)

- Events (11)

- Press Releases (1)

- Prizes (6)

- Trends (2)

Search

Subscribe to follow Go4Mobility news and industry trends.

See our Privacy Policy and Terms and Conditions.