<!-- Google Tag Manager (noscript) -->

<noscript><iframe src="https://www.googletagmanager.com/ns.html?id=GTM-N69PD2M"

height="0" width="0" style="display:none;visibility:hidden"></iframe></noscript>

<!-- End Google Tag Manager (noscript) -->

Subscronomics, the business model of the future

The new subscription economy

What is subscronomics?

There is a growing trend in subscription-based services, and this trend is expected to grow.

The subscription economy is centered on a business model where the customer receives a product or service in exchange for a recurring fee.

This practice has been reinvented today with the help of technology, becoming a new phenomenon to which, no sector is oblivious.

According to recent studies, by 2025, the subscronomics model will record a turnover of over 481 billion dollars, with an average year-on-year growth of 23%. This global industry on the rise, will be driven by almost 4 billion subscriptions.

Drivers for the fast subscronomics globalization:

- Changes in consumer habits, who no longer want to own, but enjoy

- Brands want better financial planning

- Companies are open to discovering different and new levels of potential revenue which is consistent and scalable

- Brands are oriented to build deeper, longer-term relationships with customers

- The emergence of the ‘Platform Economy’

This subscription-based model is already highly consolidated among multi-service platforms and digital content providers. Furthermore, and due in part to the pandemic together with technology disruption and the rise of new ways of interaction, is largely increasing among physical goods retailers. Medicine and daily basic supplies are a good example.

In fact, according to Juniper Research, that identified 10 key subscription-based markets, physical goods will account for the largest share within the subscription global landscape, responsible for 45% of its revenue in 2022.

In addition to that, the report also found that digital services like music, gaming, video streaming and spoken word (like podcasts) will reach 39% of the market value this year.

In response to this economic model, the largest and more established platforms and providers are now focusing on user experience and personalization to increase engagement and reduce dropout.

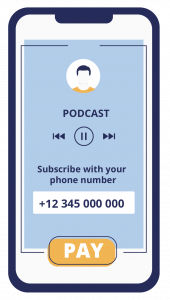

One of the key steps of the customer journey is noticeably acquisition and payment, hence the need to search for alternative digital payment methods, that can reduce payment friction and improve end-user convenience.

DCB is key to growing future subscription-based services

The subscronomics model benefits from DCB, a digital payment method that works as a powerful sales engine for platforms and merchants offering subscription models.

This solution is even more relevant in countries with a great number of unbanked mobile users or significant low credit card penetration rates.

DCB is an optimal payment method, allowing platforms and merchants to charge users on their mobile bills and securely guarantee their data privacy. Users can click and purchase, or subscribe, within seconds since there is no registration process, intermediate steps, or password. Offered in isolation or as an alternative payment method it drives revenue growth and new business by enabling demographics that are unable to pay otherwise or increasing conversion for smaller value and impulse purchase items where its convenience supersedes other methods.

Go4Mobility has the right resources to make Direct Carrier Billing accessible to providers, regardless of distance and region.

Our support

Our commercial and technical teams are ready to assist you with monetizing your digital content in the new subscription economy.

Operating in the digital payments market, Go4Mobility is committed to driving sustained growth within the mobile payments market for online sellers and merchants, developing an increasingly convenient and secure experience for consumers.

If you are looking for more information on our Direct Carrier Billing service and its global opportunities contact us at marketing@go4mobility.com or https://go4mobility.com/en/contacts

Recent articles

- VAS Glossary

- I DON’T WANT YOU TO EVEN THINK ABOUT LEAVING!

- Innovation, Trust, and the Future: An Interview with João Carlos, Business Unit Director at Go4Mobility

- Navigating the evolving landscape of Wholesale Voice: Key insights and trends

- Go4Mobility as Telecom Operators’ partner in Digital Services

Categories

- Articles (44)

- Blog (14)

- Case studies (2)

- Culture (3)

- Digital Services (1)

- Events (11)

- Interview (1)

- Press Releases (2)

- Prizes (6)

- Trends (2)